Managing metrics in your customer acquisition funnel

For a startup CEO that’s hacked through the bushes of idea validation, MVP-building and product-market-fit, one of the next big challenges is naturally how to measure success in customer acquisition.

At a first glance, this is pretty straightforward. Count the number of customers or revenue every week, put them in a deck to show your board, crack open a beer and you're done!

However, the traction chart doesn’t go upwards to the right on its own. Therefore, the key to building a reliable customer acquisition machine is understanding all of the steps that come before the deal is closed - from the first time that the customer interacts with you all the way through to the point at which they become a customer -- the journey. This is what allows a growing company to identify where user acquisition bottlenecks exist, refine their go-to-market model, and understand what factors lead to strong performance.

At this stage, you should be quite familiar with the concept of a customer acquisition funnel (if not, there's a helpful primer for both B2B and B2C businesses here). So I will dive directly into how to measure success within your funnel. Most importantly I want to help you really be in the driver seat.

Once you discover that measuring outcomes like revenue or customers isn't enough the temptation might be to try and measure everything. After all, data is good!

“Give me my discount rate, average sales price, website visits, click-through-rate, ad spend and rep productivity now!”

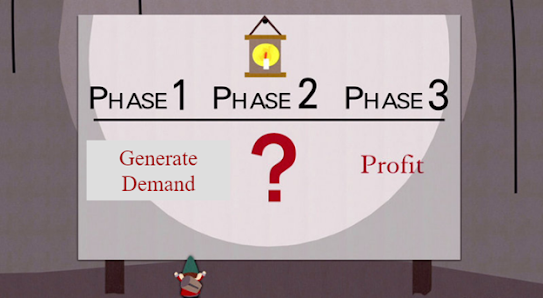

The risk here is that you end up in a sea of metrics, and it's tough to draw any real insight out of it. You may be able to relate to the following scene:

Diagnosing a revenue miss - a tragedy in one part

Setting: Conference room, Monday morning, first day of the week after SaaSCo has missed their revenue target for the third straight week.

CEO: “We need to understand why we missed our revenue target last week. Our progress recently has been good, but this is a big setback in our quarterly plan. Where is our head of sales?”

Head of Sales (mid 40s, stocky, bloodshot eyes) barges bull-like into the room, grunts and scans for victims. Locks eyes on the head of growth (mid 30s, lens-less glasses).

Head of Sales: "The reason we missed is because you didn't deliver on the demand generation numbers. They were down 10% last month! I couldn't focus while driving my Tesla this morning because I was so angry."

Head of growth: "I saw on our dashboard that the number of demos the reps were running was down 25% from last month - the demand was there but the team just didn't put the work in. Besides, the espresso machine downstairs is broken - I can't be expected to devise new campaigns without appropriate caffeination."

Head of Sales: "Our reps were just being more selective. If you take a closer look at the dashboard, you'll see that our discount rate was down. I don't trust the data in that dashboard anyway, my reps are working as hard as they can."

CEO: “?!?!?!”

There really isn't anything surprising here and we see this kind of behaviour in all walks of life, from parenting to politics. In a world lacking clear structure, we tend to gravitate towards the evidence that allows us to confirm our existing beliefs.

So how do you avoid this kind of scene? The key is structure. Having a framework for how your business works from a numbers perspective is crucial. Even Drake knows that metrics are useless without structure.

The key is to treat your customer acquisition operations like an onion. You can start from the outside and work your way in.

By breaking down revenue into its component parts and isolating the variables that are causing it to rise or fall, you’ll have a much deeper understanding of what’s driving revenue for your startup.

Now you have this well defined machine, let's step through an example of how this works.

We signed more customers than ever, but still missed our target - what happened?

If you're using a hierarchy something like the above, you'll know that if customers acquired exceeded target but revenue numbers did not, then it must be that revenue per customer wasn't where it needed to be:

From there you can dig to the next level. If you were to see that your average discount rate was up, you'd know that that's the culprit behind the revenue miss.

The discussion can then focus on next steps to address the issue, like sales coaching or focusing on different customer types, rather than on diagnosis. Best of all, you haven't gone on a wild goose chase down the left-hand branch of metrics. This helps avoid time, effort, and organisational strain by making analysis quick, transparent and objective. Perhaps more importantly, having a framework like this allows you to avoid the diagnosis process turning into a process of assigning blame.

Let’s take a look at another example.

We generated more leads than ever, but revenue was stagnant from last month - what happened?

Although it might seem counterintuitive, the best place to start here is at the end. We know that because Leads Generated is on the left-hand-side of our metrics hierarchy it should ultimately flow through to an increased number of customers (and of course revenue).

So the first place to check is - did we see this increased number of customers? If we did, then we know that Revenue per Customer is the culprit and we should explore there. If we didn’t, then something upstream on our left-hand-branch is broken and we need to dig there.

If the number of customers acquired was flat, then the next place to check is the demo stage of our funnel. If at that point we found that our demo-to-close rate was down, we can safely pinpoint this as the issue.

Of course, what exactly your framework looks like will depend heavily on the nature of your business, but I hope this blog provided you with a good place to start. And once you have built your own and begin using it, as CEO you can stop chasing your tail and get back to managing your fast growing business.

Comments

Post a Comment