What should your go-to-market strategy be in new markets?

As CEO of a fast-growing startup entering into a new market, at some point you will need to reevaluate your go-to-market. In some ways entering a new market is a negotiation. There are terms that the market will set for you, and there are also terms that you should be setting yourself as the CEO.

New markets will demand things from your company that will be unfamiliar. Maybe you need to take payment using local methods or currency. Maybe the local market calls for additional services beyond your current offerings. Or maybe it's simply that you don't speak the local language - entering Vietnam is pretty tough if you don't have Vietnamese-speaking sales, marketing, or customer success muscle. In any market entry, figuring out what new capabilities are required of you by the market is a key factor in your decision-making. At the same time, there are also terms that you should be setting. This article will mostly deal with how you should decide these terms, and what the implications are.

Category 1 challenges - requirements the market will impose on you

Any market will have table-stakes requirements you need in order to operate successfully. If your company lacks these capabilities, the key decision to make is whether you need to build, partner, or buy it from somewhere else.

Whether you build, partner or buy will be determined by three factors.

Is it possible for you to build the capability?

In some cases, it simply won't be possible for you to build capability. For example in China, there are legal and regulatory blockers to foreign firms operating wholly owned subsidiaries that make partnership necessary.

Is it cost-effective for you to do so?

In other situations, it may be that building is not something that's cost-effective to do. To give an example, building a machine translation program from scratch is likely not a good idea for your startup when there are several vendors in the space. If it’s not an activity that’s core to your value proposition, and a third-party vendor will do the work for you for a reasonable fee, why would you want to build the capability yourself?

Is it a core value proposition you should really own?

If you lack the capability but it makes strategic sense to develop the capability - you'll likely employ a more transitionary approach where you supplement your capabilities in the short-run, with a view to building them yourself over the long-run.

Category 2 challenges - terms you should be setting yourself

This is a step that is often skipped, but is absolutely crucial. It’s very easy to focus on what the market wants from you, and to ignore the things you also need to have in place to make entry worthwhile and effective. Key among these can be illustrated by looking at unit economics. The new challenge here is that customer lifetime value (LTV) is not the same across markets. Because different go-to-market strategies have very different customer acquisition costs, you need to monitor this closely.

If your price point, retention numbers or margins vary across markets, it may not be profitable for you to copy-and-paste your existing playbook. In Southeast Asia, you can see the large spread of LTV numbers you can have across markets. Here is some illustrative data for Southeast Asia - you can see the wide spread of customer LTVs across markets:

Data here

This can be a huge pothole for startups in the scale-up phase of their growth. The relentless chase for revenue and customers often means we enter new markets by scaling up our existing operating system rather than making the hard choices that adaptation would require. However, this will sting in the long run - especially if we're trying to bring a developed market playbook into an emerging market.

We can see below that while it might be worthwhile to acquire Singaporean consumers using paid ads, it's a losing strategy in most other markets. Likewise in the B2B context, employing sales reps will be a good use of your company's scarce resources in more developed markets like Singapore and Taiwan, but not in Cambodia.

These numbers will move around over time, especially in fast-growing markets like Indonesia or Vietnam. It’s important to take a forward-looking perspective when assessing your go-to-market strategy and also examine factors like anticipated GDP growth or inflation. This will help you to form an opinion as to what LTV will be in the future, as opposed to what it is today.

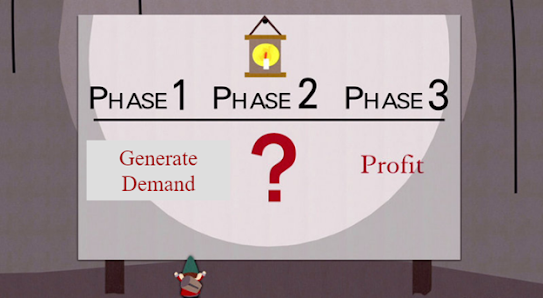

Choosing which markets to enter is very important and deservedly gets much attention in management meetings, tech twitter, and elsewhere. Choosing how to enter gets less attention but is every bit as important. When expanding, the temptation to copy-and-paste your existing user acquisition and retention model onto new markets is huge. However while making changes is difficult, it is the best way to ensure sustainable unit economics in the long-run.

Implications for “SEA” Startups

In a world where emerging markets are accounting for a large share of the pie, a copy-and-paste approach will leave a tonne of lost opportunity on the table. Within Southeast Asia, emerging markets make up a significant majority of the region's GDP. Part of what makes Southeast Asia so unique in the tech world is this variation in economic conditions.

In markets like North America or Europe there are lots of Category 1 challenges with various languages, regulatory requirements and other demands the market imposes on expanding companies. However, there are fewer Category 2 challenges where a company needs to employ a fundamentally different customer acquisition strategy across markets. Managing this diversity is part of the challenge (and fun!) of expanding in Southeast Asia, and overcoming it will create an unparalleled competitive advantage for your startup.

Comments

Post a Comment