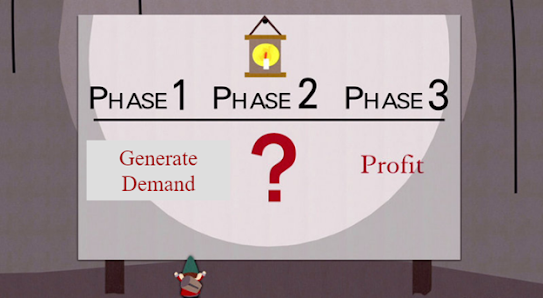

Thoughts on setting prices in new markets

When entering new markets one of the big, difficult-to-reverse decisions you need to make is what price to set. This is a tricky question that involves both human, analytical, and operational components to your decision-making and is important to consider carefully. Pricing is one of the most important activities your startup will undertake. Infact a 1% increase in price leads to an 11% increase in profitability on average! Unfortunately pricing in early stage tech startups has usually been more art than science, and founders often feel lost trying to make decisions.

So where to start? Setting a publicly-announced price is a high-commitment decision that is difficult to back out of, especially if you've already established a home base. Starting with baby steps in the form of temporary targeted promotions, test prices with pilot customers, or other limited forms of experiments will allow you to get a sense for what works while not committing yourself to a price that might not be right for the long-term.

In any experiment you’ll want to gather at least two data points - price offered and whether or not the customer purchased (you should also collect other data that impacts price sensitivity like size of company too if that’s feasible).

How you experiment and gather this data will look different depending on your business model. Here are some examples of what that might look like in different settings:

An analytical framework for assessing pricing

In assessing what sort of a price makes the most sense for a new market, I'll offer a framework that is applicable to any business model and needs only a handful of inputs to establish what price level makes sense.

This spreadsheet has a mocked-up model assuming a regular list price of $2,000 and some price sensitivity estimates (details of how to calculate the price sensitivity are also in the spreadsheet). You can copy the sheet and adjust these to your business’ own data.

In the graph, the highest point of the curve represents the optimal price point - you can see that two different markets can have very different optimal price points based on their price sensitivity.

By running this analysis for different markets or products, you can get a sense for how well-priced your products are and how you should think about adjusting your pricing moving forward.

Next steps

Assess operational concerns

There are significant operational concerns in offering different prices for different types of markets. Key among these is the risk of cannibalising an existing market if you don't have a good way of distinguishing where your customers are located. After all, setting a lower price for the Thai market is only useful if you can appropriately identify who your Thai customers are - otherwise you're just giving away a price decrease to everyone!

Another important consideration is the quality of the data you're using to make the decision. Experimentation is useful, you also don't want to run haywire. It's important to have controls around what experiments can be run, and how they can be run in your process. This might mean restrictions on what sorts of discounts can be offered or running only one pricing test at any given point in time.

Think through price segmentation

If your curve peaks at $1,500 and you’re in a situation where you can charge different prices to different customers (via targeted discounting, promotions or other mechanisms) it would be a mistake to say you should be pricing at $1,500 across all of your deals or transactions. This fallacy is known as the “sex panther” school of price-setting.

After all, you should want to charge everyone the maximum you can get out of them. In reality, judgement calls from your sales or marketing teams about an individual or group of customers' willingness-to-pay can be more important in any individual situation than an aggregate analysis. However, when assessing your pricing or discounting strategy overall these are extremely helpful tools in assessing whether you're too hot, too cold, or just right.

What does best-in-class look like?

A great example of localised pricing is Spotify. As we’ll see in a little bit, Spotify adjusts its pricing (sometimes significantly) to match the price sensitivity of the local market. One interesting point of note here is that macroeconomic factors like GDP per capita don’t necessarily explain Spotify’s pricing. Some markets like the UK have prices higher than you would expect, and some like Singapore have prices that are much lower than you would expect. Dynamics like this are why it’s so important to experiment and gather information on your company’s specific market conditions before determining a price.

Another example of a Southeast Asian tech startup (and friend of my former employer AppWorks) that puts a lot of thought into price localisation is ShopBack. ShopBack segments their customers into different groups for pricing based on having different websites for their different markets.

They then change their pricing, referral bonuses and other mechanisms based on the sensitivity and economics of the local market. A clear-cut example visible on their homepage is their referral bonus. On the Australian site, the bonus is AUD$5 per referral.

However, on the Malaysian site on the other hand, it’s RM15 for 2 referrals (equivalent to about AUD$2.5 per referral).

By using strategies like this, ShopBack has been able to scale across a range of Southeast Asian markets with very different market conditions.

This is a great illustration of a company going through the steps of price localisation. They have established a way of dividing their customers into separate groups via local websites, assessed the relative price sensitivity of each customer group, and implemented different pricing strategies for their different markets. If you can execute on this in your own startup, you’ll be in a great position to maximise value and deliver strong performance.

Comments

Post a Comment